New Adjustments to Hainan's Offshore Duty-Free Shopping Policy!

2025-10-28

Latest News!

Ministry of Finance, General Administration of Customs, State Taxation Administration Announcement on Adjusting the Duty-Free Shopping Policy for Outbound Passengers from Hainan

↓↓↓

(Official Website Screenshot)

Announcement on Adjusting the Duty-Free Shopping Policy for Outbound Passengers from Hainan

Ministry of Finance, General Administration of Customs, State Taxation Administration Announcement No. 9 [2025]

To further amplify the policy effects and support the development of the Hainan Free Trade Port, the adjustments to the Duty-Free Shopping Policy for Outbound Passengers from Hainan (hereinafter referred to as the Outbound Duty-Free Policy) are announced as follows:

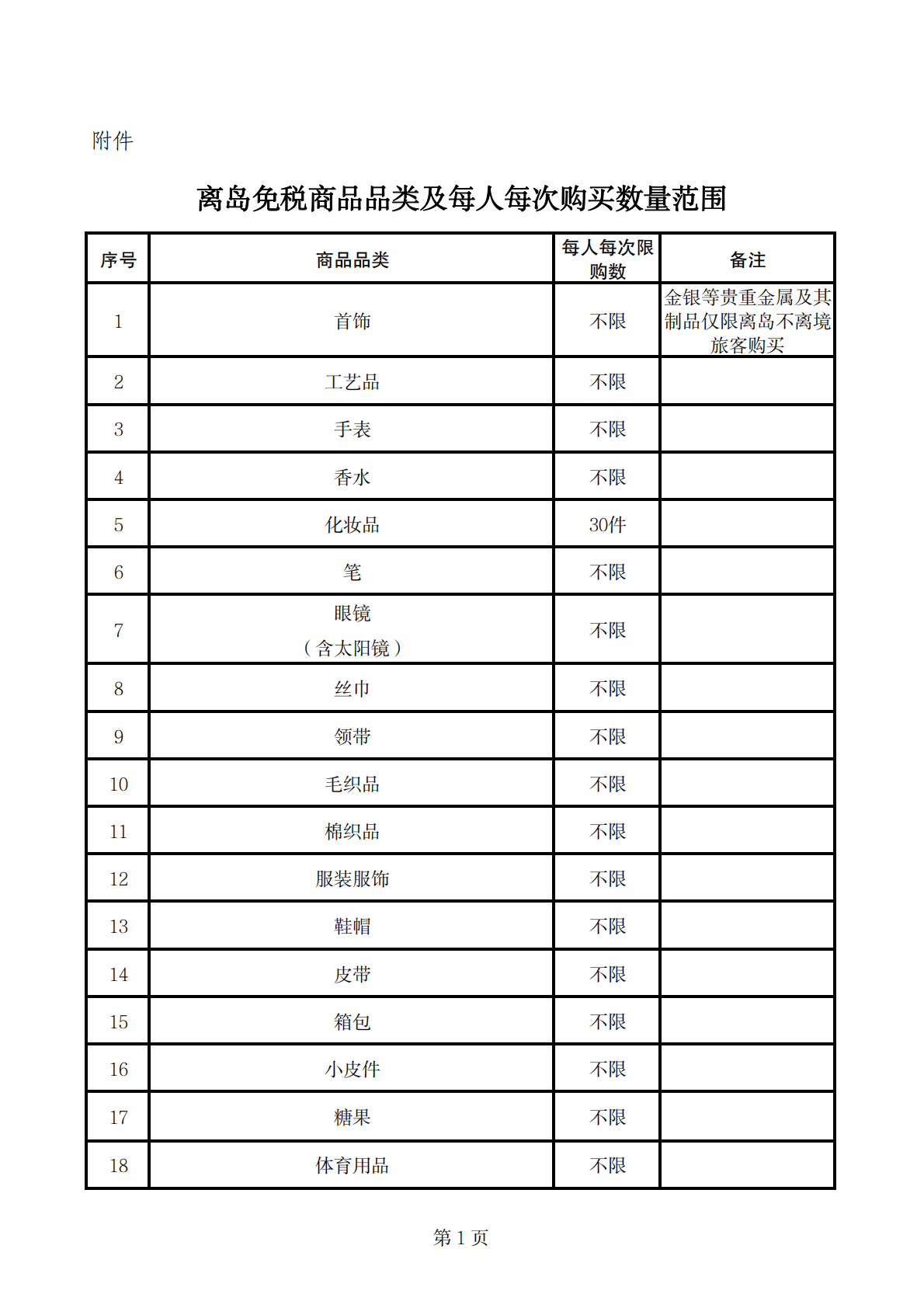

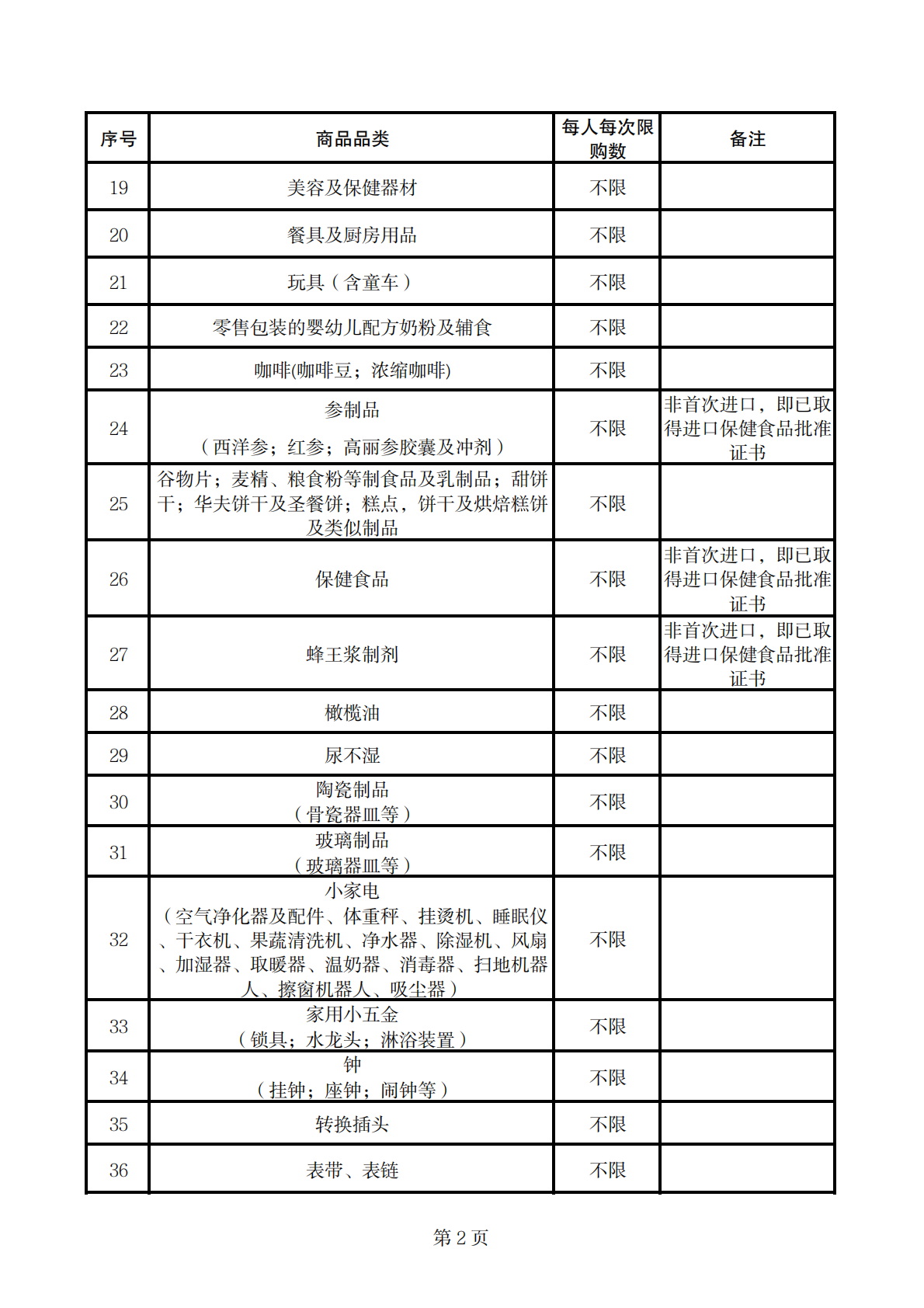

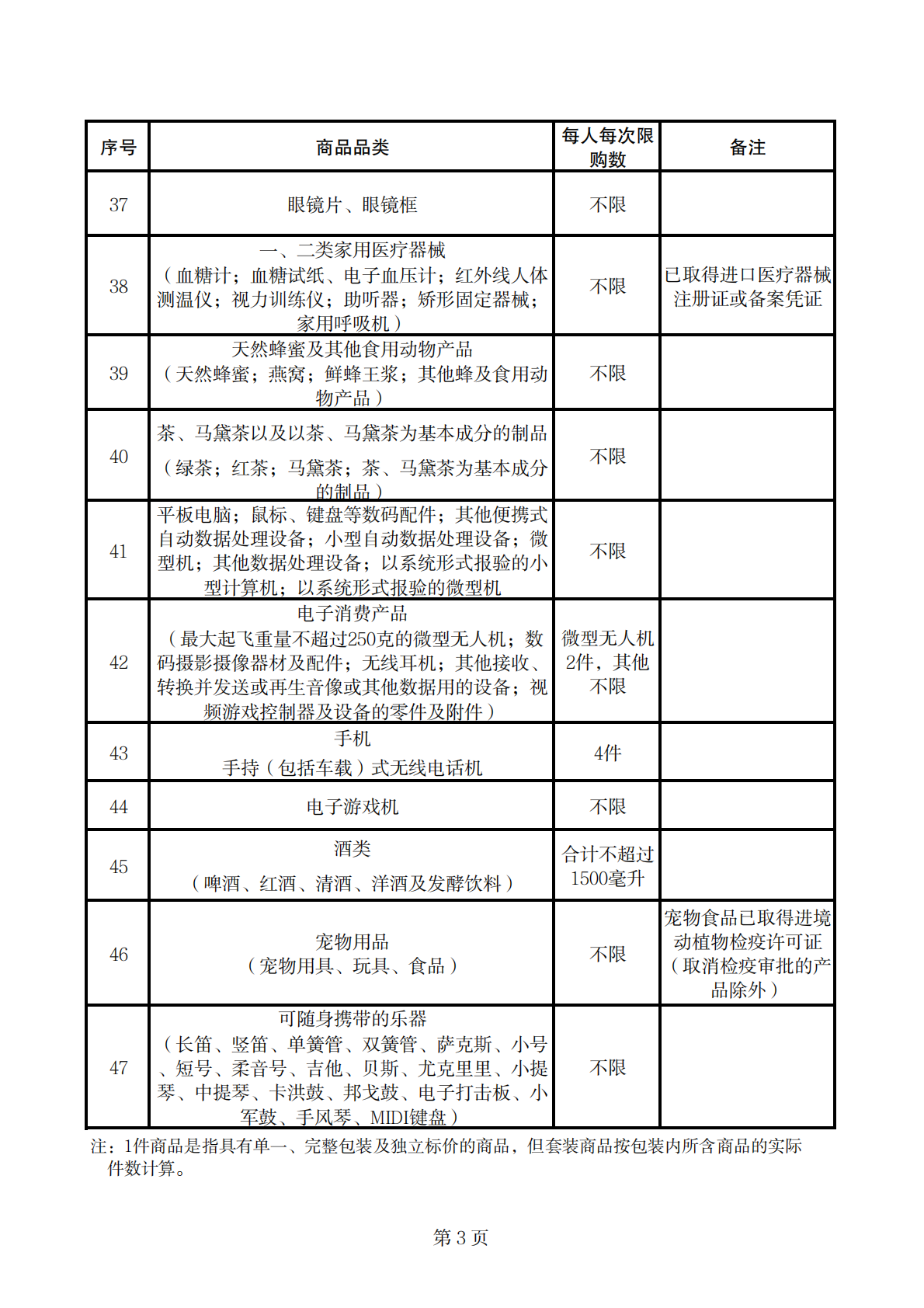

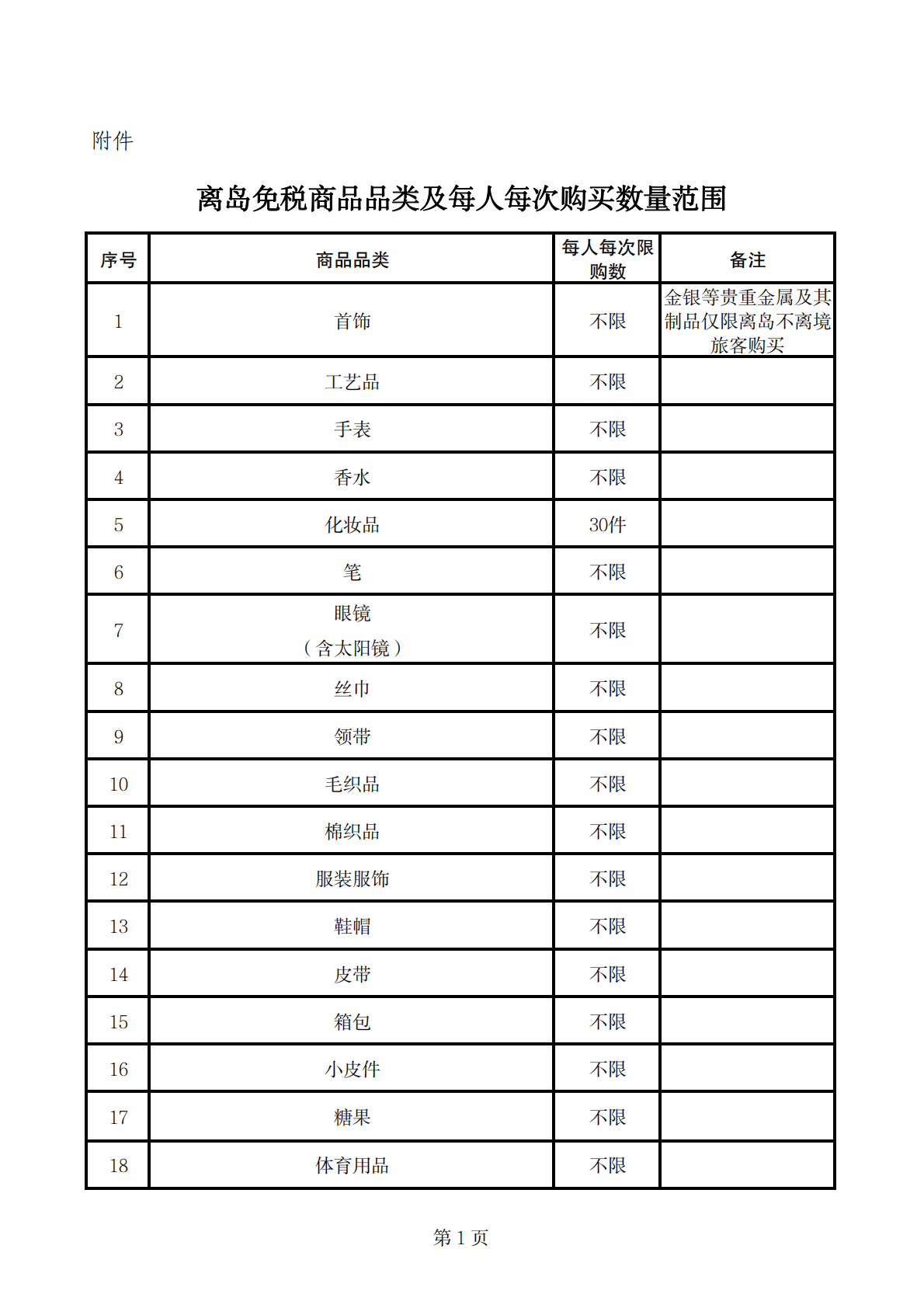

- Two new categories of goods are added: Pet Supplies and Portable Musical Instruments. The category "Household Air Purifiers and Parts" is adjusted to "Small Household Appliances," adding items such as robot vacuum cleaners and vacuum cleaners. The category "Wearable Devices and Other Electronic Consumer Products" is adjusted to "Electronic Consumer Products," adding digital photography/videography equipment and accessories, and mini drones. Under the "Tablet Computers" category, digital accessories such as mice and keyboards are added.

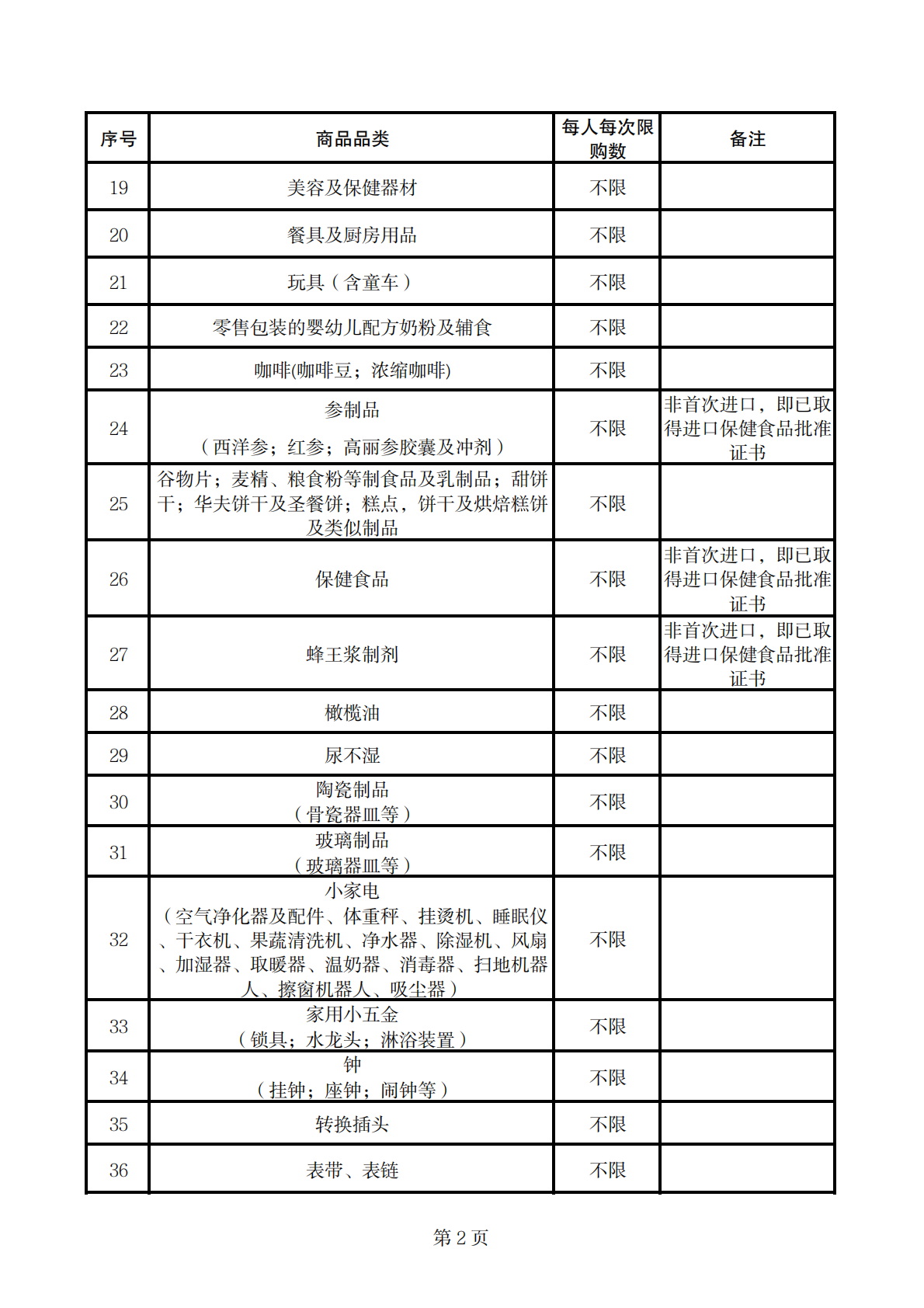

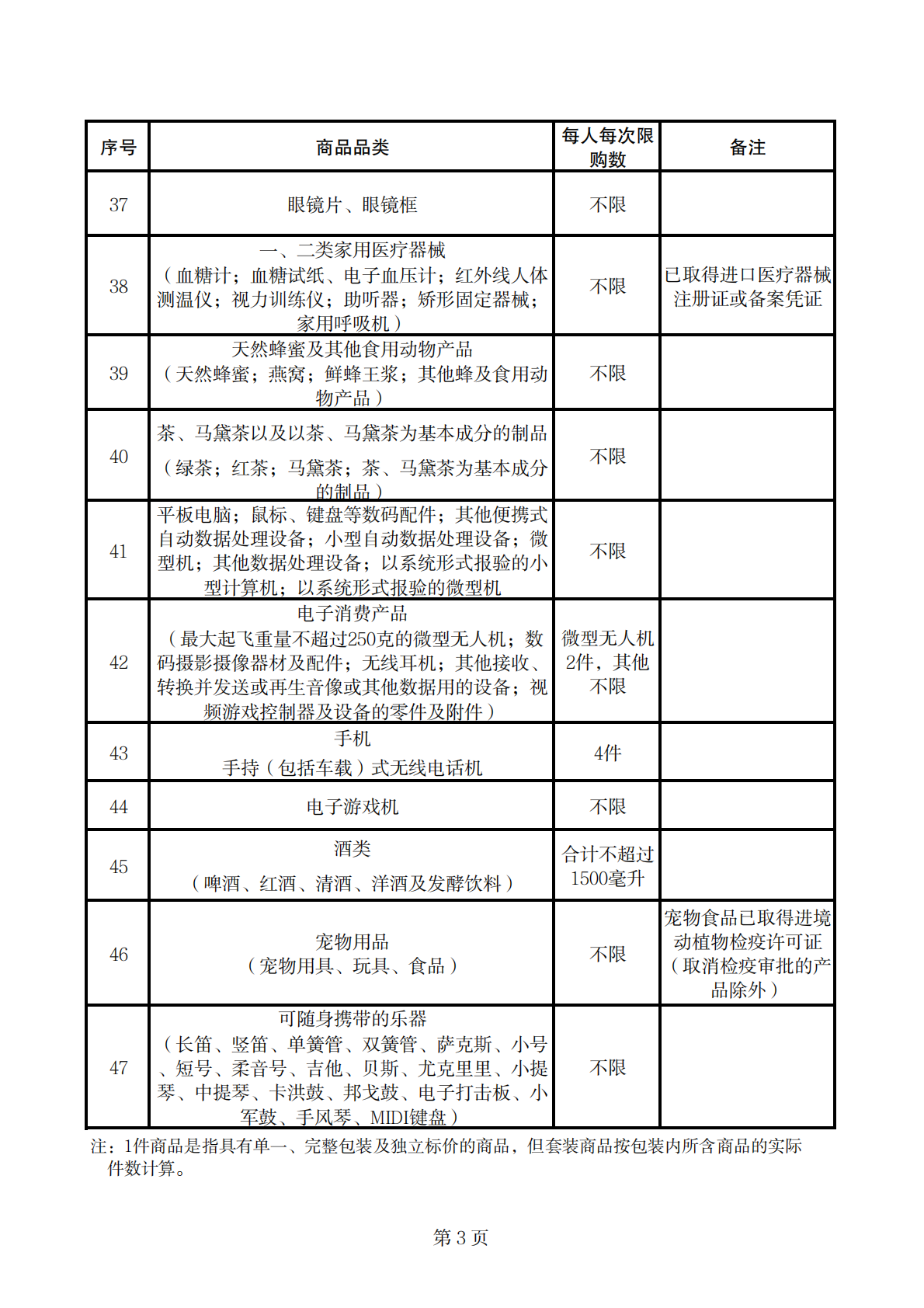

After the adjustments, there are a total of 47 categories of outbound duty-free goods. Specific categories, purchase quantity limits, and remarks are detailed in the attachment and shall be implemented accordingly. - Business entities qualified to operate outbound duty-free goods, when purchasing domestic goods including Silk Scarves (Attachment Serial No. 8, same below), Clothing and Apparel (No. 12), Footwear and Headwear (No. 13), Coffee (No. 23), Ceramic Products (No. 30), and Tea (No. 40), and selling them in outbound duty-free shops under the Outbound Duty-Free Policy, such sales shall be treated as exports, with Value-Added Tax (VAT) and Consumption Tax refunded (exempted). For sold domestic goods, the aforementioned business entities may complete export declaration procedures with Customs and apply for tax refunds with the competent tax authorities according to regulations. Specific supervision and tax refund measures will be formulated separately by the General Administration of Customs in conjunction with the Ministry of Finance and the State Taxation Administration.

- The minimum age for outbound passengers to be eligible for duty-free shopping is adjusted from 16 years old to 18 years old.

- "Outbound and Exiting Passengers" are allowed to enjoy the Outbound Duty-Free Shopping Policy. Outbound and Exiting Passengers refer to domestic and foreign passengers, including Hainan residents, who are 18 years or older, have purchased air or ship tickets for exiting China via Hainan, hold valid entry-exit documents, and actually exit the country.

The amount spent by Outbound and Exiting Passengers on outbound duty-free goods counts towards their annual duty-free shopping quota of RMB 100,000, with no limit on the number of shopping trips. The categories of duty-free goods and purchase quantity limits per trip shall comply with the attachment.

Within the specified quota and quantity limits, Outbound and Exiting Passengers can purchase duty-free goods in outbound duty-free shops or via approved online sales windows. The duty-free shops will arrange shipment of goods based on the passenger's departure time. Passengers can only pick up the goods at designated areas in the airport or seaport terminal using their purchase vouchers and must carry them away upon departure in one go. - Island Residents with an outbound travel record within a natural year can purchase outbound duty-free goods under the "Purchase and Immediate Pick-up" method an unlimited number of times within that same natural year. For the year of policy implementation, the outbound record must occur on or after the effective date of this Announcement. The People's Government of Hainan Province shall effectively assume the primary responsibility for preventing and controlling the risk of "organized resale and smuggling" ("tao dai gou").

Island Residents refer to Chinese citizens aged 18 or older holding a Hainan ID card, Hainan residence permit, or social security card, as well as foreign nationals working and living in Hainan holding a valid residence permit. - Other aspects of the Outbound Duty-Free Policy shall continue to be implemented in accordance with the relevant provisions of the "Ministry of Finance, General Administration of Customs, State Taxation Administration Announcement on the Duty-Free Shopping Policy for Outbound Passengers from Hainan" (Ministry of Finance, General Administration of Customs, State Taxation Administration Announcement No. 33 [2020]).

This Announcement shall take effect on November 1, 2025.

Hereby Announced.

Attachment: Categories of Outbound Duty-Free Goods and Purchase Quantity Limits Per Person Per Trip.pdf

Ministry of Finance

General Administration of Customs

State Taxation Administration

October 15, 2025

Latest News!

Ministry of Finance, General Administration of Customs, State Taxation Administration Announcement on Adjusting the Duty-Free Shopping Policy for Outbound Passengers from Hainan

↓↓↓

(Official Website Screenshot)

Announcement on Adjusting the Duty-Free Shopping Policy for Outbound Passengers from Hainan

Ministry of Finance, General Administration of Customs, State Taxation Administration Announcement No. 9 [2025]

To further amplify the policy effects and support the development of the Hainan Free Trade Port, the adjustments to the Duty-Free Shopping Policy for Outbound Passengers from Hainan (hereinafter referred to as the Outbound Duty-Free Policy) are announced as follows:

- Two new categories of goods are added: Pet Supplies and Portable Musical Instruments. The category "Household Air Purifiers and Parts" is adjusted to "Small Household Appliances," adding items such as robot vacuum cleaners and vacuum cleaners. The category "Wearable Devices and Other Electronic Consumer Products" is adjusted to "Electronic Consumer Products," adding digital photography/videography equipment and accessories, and mini drones. Under the "Tablet Computers" category, digital accessories such as mice and keyboards are added.

After the adjustments, there are a total of 47 categories of outbound duty-free goods. Specific categories, purchase quantity limits, and remarks are detailed in the attachment and shall be implemented accordingly. - Business entities qualified to operate outbound duty-free goods, when purchasing domestic goods including Silk Scarves (Attachment Serial No. 8, same below), Clothing and Apparel (No. 12), Footwear and Headwear (No. 13), Coffee (No. 23), Ceramic Products (No. 30), and Tea (No. 40), and selling them in outbound duty-free shops under the Outbound Duty-Free Policy, such sales shall be treated as exports, with Value-Added Tax (VAT) and Consumption Tax refunded (exempted). For sold domestic goods, the aforementioned business entities may complete export declaration procedures with Customs and apply for tax refunds with the competent tax authorities according to regulations. Specific supervision and tax refund measures will be formulated separately by the General Administration of Customs in conjunction with the Ministry of Finance and the State Taxation Administration.

- The minimum age for outbound passengers to be eligible for duty-free shopping is adjusted from 16 years old to 18 years old.

- "Outbound and Exiting Passengers" are allowed to enjoy the Outbound Duty-Free Shopping Policy. Outbound and Exiting Passengers refer to domestic and foreign passengers, including Hainan residents, who are 18 years or older, have purchased air or ship tickets for exiting China via Hainan, hold valid entry-exit documents, and actually exit the country.

The amount spent by Outbound and Exiting Passengers on outbound duty-free goods counts towards their annual duty-free shopping quota of RMB 100,000, with no limit on the number of shopping trips. The categories of duty-free goods and purchase quantity limits per trip shall comply with the attachment.

Within the specified quota and quantity limits, Outbound and Exiting Passengers can purchase duty-free goods in outbound duty-free shops or via approved online sales windows. The duty-free shops will arrange shipment of goods based on the passenger's departure time. Passengers can only pick up the goods at designated areas in the airport or seaport terminal using their purchase vouchers and must carry them away upon departure in one go. - Island Residents with an outbound travel record within a natural year can purchase outbound duty-free goods under the "Purchase and Immediate Pick-up" method an unlimited number of times within that same natural year. For the year of policy implementation, the outbound record must occur on or after the effective date of this Announcement. The People's Government of Hainan Province shall effectively assume the primary responsibility for preventing and controlling the risk of "organized resale and smuggling" ("tao dai gou").

Island Residents refer to Chinese citizens aged 18 or older holding a Hainan ID card, Hainan residence permit, or social security card, as well as foreign nationals working and living in Hainan holding a valid residence permit. - Other aspects of the Outbound Duty-Free Policy shall continue to be implemented in accordance with the relevant provisions of the "Ministry of Finance, General Administration of Customs, State Taxation Administration Announcement on the Duty-Free Shopping Policy for Outbound Passengers from Hainan" (Ministry of Finance, General Administration of Customs, State Taxation Administration Announcement No. 33 [2020]).

This Announcement shall take effect on November 1, 2025.

Hereby Announced.

Attachment: Categories of Outbound Duty-Free Goods and Purchase Quantity Limits Per Person Per Trip.pdf

Ministry of Finance

General Administration of Customs

State Taxation Administration

October 15, 2025